- 813-602-4814

Why Do People Contempt Solar Energy Before Investigating?

Why do people contempt solar energy before investigating? Unfortunately, one of the most challenging things that have held home solar installations back is politics related to climate change and global warming. Some food for thought, Florida passed solar legislation in 1978 The Florida Solar Rights Act enacted in 1978. If the global warming and climate change debate never existed solar energy is still a Great Idea, and they knew that in 1978! The Florida Solar Rights Act enacted in 1978 is still the law of the land in 2024.

In 1978 solar energy existed in relative obscurity, and solar energy had no connection to politics whatsoever. Fast forward to 2010 and suddenly solar energy is thrown into the political debate about climate change, and global warming. The problem is solar energy has nothing to do with the climate change debate. Solar energy is simply a good idea! Solar energy doesn’t threaten anybody or anything, it’s a commonsense approach to a need, but was previously not cost-effective.

There’s absolutely nothing political about a great idea for humanity. Solar energy is in harmony with nature, and that’s why it’s popular, and isn’t going away. The reason solar energy is becoming mainstream is because it’s cheaper to produce, versus in 1978 when the technology was too expensive and or nonexistent.

Pros

Solar Companies Have Evolved in 2024: Fast forwarding the solar industry has evolved. The growing pains of the past were the teacher for the present in the solar industry. Since 2017 the landscape has changed for the solar industry because everybody involved is educated about home solar.

The solar industry has evolved into national solar installation companies using technology to trim overhead costs and bring all the solar experts together on one platform. Your Solar Advocate’s national installation partner demands transparency first and foremost from their advocates. all advocates and installation contractors must be certified solar experts. Our national solar installation company has done over 25,000 solar installations exceeding 1 billion dollars in sales.

It’s difficult to imagine but in 2017 there wasn’t much helpful information for homeowners interested in home solar. In 2024 educating oneself about home solar is relatively easy because blogs like this help to inform homeowners about solar energy. To be clear, if Your Solar Advocate never sold a solar system again, but homeowners still went solar we are happy. We are advocates for home solar, not solar sales. Your Solar Advocate is on the homeowner’s side, looking out for their best interests.

Cons

Solar Energy Growing Pains: Until 2016, the permissibility of rooftop solar panels in Florida remained uncertain. Florida voters considered a solar energy-related measure known as Amendment 1. However, it was defeated. Amendment 1 was a back door method for the power companies to charge homeowners fees that would make home solar panels impractical.

The Florida Solar Rights Act enacted in 1978 remained the law of the land in Florida after Amendment 1 failed. Rooftop solar became a safe investment for homeowners in Florida. In January 2017 solar sales took off like a rocket but there was a huge problem on the horizon.

In 2017 solar energy was as new to the people selling it as it was to people buying it. In a state the size of Florida there was an instant demand for solar and homeowners were excited about it.

Regrettably, the solar industry drew individuals inexperienced in managing substantial amounts of other people’s funds. Consider this: a solar company that sold a home solar system for $35,000 netted a $5,000 profit. Even minor setbacks can jeopardize a company operating on narrow margins, leading to financial losses. Consequently, numerous solar company owners faced the dilemma of either struggling to survive or misappropriating funds from their companies, which were entrusted with millions of dollars from clients.

Pros

Solar Energy is a Free Investment: Homeowners can use the money they pay the power company monthly to offset the cost of solar energy; making home solar a free investment opportunity.

The same logic used to buy a home applies to purchasing a home solar system, owning is better than renting. The power company rents homeowners electricity, so no matter how much time goes by the only thing the power company has for you is a higher power bill. Solar energy is cheaper than its counterpart, but it’s not the only reason to go solar.

Cons

Solar Energy is Boring: You can’t touch it, you can’t feel it, you can’t wear it, you can’t eat it or drive it, all the elements of a tangible product do not apply to solar energy. Solar energy doesn’t have a physical form or substance.

It’s not something you can feel, wear, or consume. Instead, it’s a form of energy that powers our world without material presence. Unlike food or fuel, solar energy isn’t consumed or depleted when used. It’s a renewable resource, constantly replenished by the sun. We harness it without diminishing its availability.

Pros

Solar Energy is Profitable: In 2018 Duke Energy of Florida was charging a base rate of .13 cents per kilowatt hour, in 2024 the base rate is .24 per kilowatt hour. It’s interesting how many homeowners didn’t notice the dramatic price increase in power costs. The power companies timed their rate hikes when the widespread use of LED lighting decreased consumption and the price increases weren’t noticed.

Net metering one-for-one power trade means a homeowner is paid full retail for power produced from a home solar system, limited to what they consume. Net Metering wasn’t the power company’s idea, it came from Federal and State legislation. in addition, net metering forces the large power companies in certain states to allow homeowners to store solar energy production on the grid, for a minimal monthly service charge.

The spread for what solar costs compared to what you’ll get in return is in the tens of thousands of dollars. Homeowners cannot lose money paying cash for a home solar system. Paying cash for a home solar system is as sure of a bet as there is, you cannot lose. Paying cash for home solar and the ITC tax credit offers the best return on investment possible.

Cons

Solar Installation is Expensive: This statement is an absolute myth because relative to what any home improvements cost, home solar is a bargain. What makes home solar unique is that the money you’ve been paying the power company can be used to offset the cost of solar.

The 30% ITC tax credit increases return on investment, making home solar a bargain compared to any other home improvement that a homeowner can make. Home solar can earn tens of thousands of dollars in return on investment over the long term.

Without question, to say home solar is expensive is a misrepresentation of the cost of solar energy. Many homeowners want something more miraculous than solar energy is, because they want it to cost pennies on the dollar and it never will. Anything that requires a general contractor, engineered design, permitting, and an installation crew isn’t going to be cheap.

Pros

Home Solar Increase Home Values: Studies show that homes with solar energy systems sell for more than those without. Owning (rather than leasing) the system increases property value significantly.

Homes with solar panels often attract environmentally conscious buyers. Zillow found that homes with solar power sell for an average of 4.1% more than comparable homes without solar. The combination of solar increasing a home’s value and the ITC tax credit makes solar a sound investment for homeowners and rental properties, short or long-term.

Cons

Home Solar Requires a Long-Term Commitment: No doubt about it, home solar energy requires a commitment by the homeowner, but that doesn’t mean you lose money in the short term. Purchasing a home solar system is no different than buying a home, they’re both investments that pay bigger dividends as time passes.

A homeowner should be committed before they purchase a home solar system. Homeowners who lack commitment to home solar lose money every day. The point of going solar sooner than later is to start making money sooner rather than later.

Pros

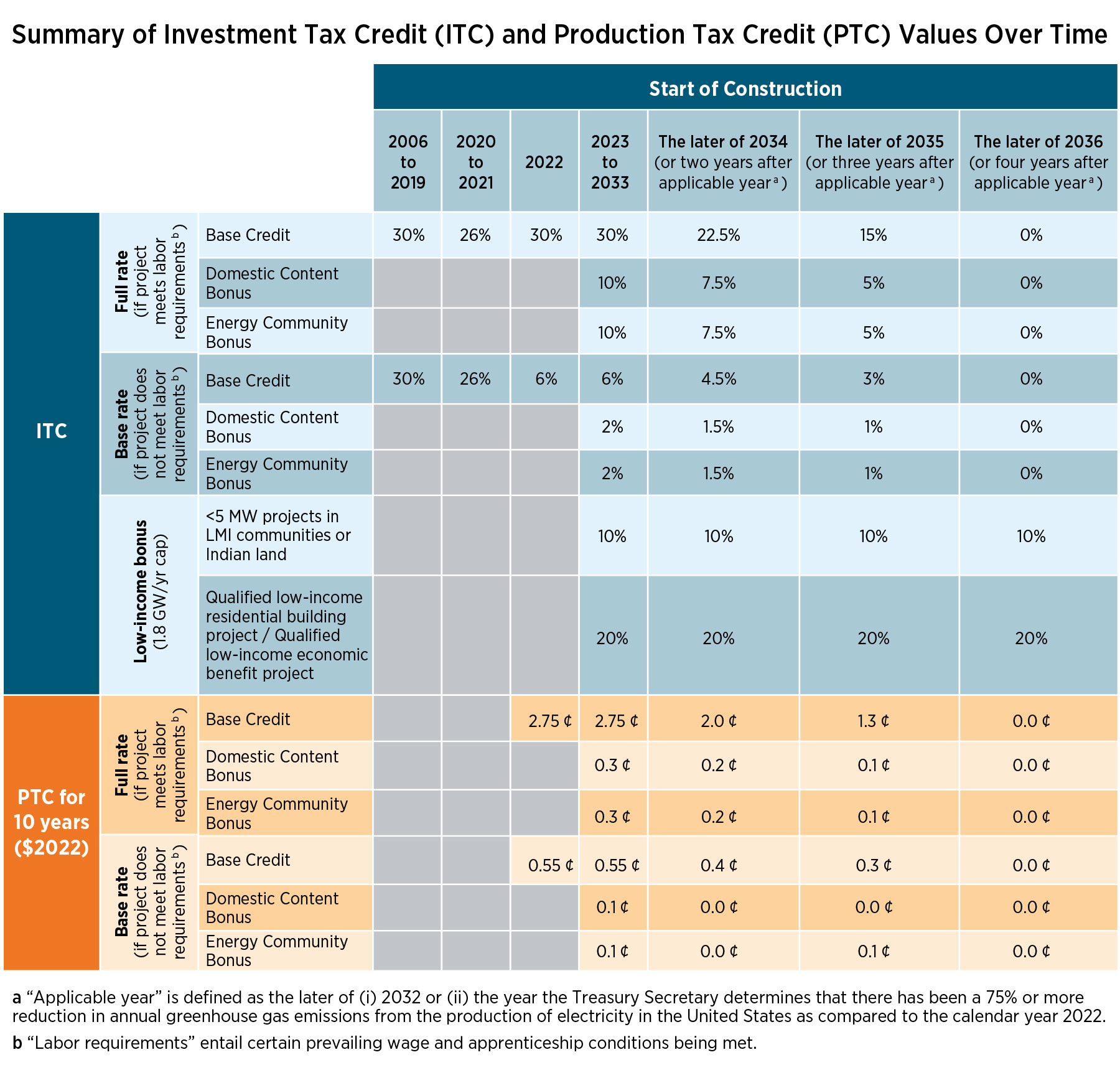

30% ITC Tax Credit: The ITC renewable energy tax credit: To promote cleaner more abundant energy congress passed Smart Grid legislation in 2008 and put America on the path of a healthier environment.

Smart grid legislation combined with leadership providing subsidies for going solar offers an alternative to homeowners. The ITC tax credit reduces the cost of solar panels to wholesale costs.

The ITC tax credit is designed to accelerate home solar purchases, and it has worked incredibly well. A 30% savings ensures homeowners’ power cost goes down, making solar energy cheaper than dirty energy.

When a homeowner shops for solar it’s best to focus on the total cost because that’s what you will be paying. The ITC tax credit comes into play during tax season, not at the time of purchase.

Cons

The ITC tax credit has been a double-edged sword for the solar industry. On the one hand, homeowners can save 30% going solar, but on the other hand, it’s been misunderstood by many homeowners; only Many homeowners find out they don’t qualify for the tax credit after they’ve purchased home solar.

Far too many homeowners have interpreted the ITC tax credit as a solar rebate. The ITC tax credit has qualifiers whereas a rebate doesn’t. When solar became a thing in 2017 and homeowners were excited about an alternative power source, salespeople let homeowners believe the tax credit was a rebate so they could close the sale. These unscrupulous salespeople duped many homeowners into believing they would get a fat check from the government for going solar when they didn’t have a qualifying income tax liability.

Misrepresentation of the ITC tax credit has been a huge blackeye for the solar industry as a whole. the only thing a solar sales rep can say about the tax credit is “how much it would be” if they qualify for it. It’s in the homeowner’s hands to consult with their tax experts to determine their eligibility for the tax credit, not a salesperson.

Why Do People Contempt Solar Energy Before Investigating? Because Solar Energy is Misunderstood

ITC Tax Credit Example 1.

The home solar tax credit is $5000, and the homeowner has paid in advance or owes $10,0000 in income taxes. They can claim the full amount of their solar tax credit when they file taxes for that calendar year. Deduct $5000 from their $10,000 tax liability and they only pay $5000 in taxes for that year. This is a completed tax credit claim for $5000. The amount of the tax credit is a one-time deal, once used up, it’s completed.

ITC Tax Credit Example 2.

The home solar tax credit is $5000, and the homeowner has paid in advance or owes $$3000 in income taxes. The homeowner cannot claim the full amount of their solar tax credit when they file taxes for that calendar year. A $5000 tax credit exceeds the $3000 tax liability. The homeowner is limited to a $3000 credit for that calendar year but can roll over the $2000 in the next calendar year for “up to but not exceeding 5 years” to exhaust the tax credit.

ITC Tax Credit Example 3.

In this example, the homeowner has a $5000 tax credit, but they’re retired and have no taxable income. They cannot qualify for the ITC tax credit without an income tax liability for the calendar year of their solar purchase. This is where many salespeople have misrepresented the tax credit because the homeowner doesn’t find out until tax season rolls around and they learn they don’t qualify for the tax credit.

Disclaimer: It’s imperative to Seek Expert Advice for the ITC Solar Tax Credit Because No Two Homeowners’ Income Taxes are the Same. Consult with a Tax Expert to Determine if You Qualify for the ITC Tax Credit and How Much You Qualify for Per Year.

Rotate Device to View Charts Below

Disclaimer: It’s imperative to Seek Expert Advice for the ITC Solar Tax Credit Because No Two Homeowners’ Income Taxes are the Same. Consult with a Tax Expert to Determine if You Qualify for the ITC Tax Credit and How Much You Qualify for Per Year.

Your Solar Advocate Reduces the Cost of Solar Without Sacrificing Quality

Your Solar Advocate Provides Transparent Pricing

Why Do People Contempt Solar Energy Before Investigating, Because It's a New Thing!

Why Do People Contempt Solar Energy Before Investigating? Because Solar Energy is Misunderstood

Your Solar Advocate © 2024 All Rights Reserved.